Steps to Start Embracing Autonomous Finance

Embracing Autonomous Finance: A Guide for AEC Firms

Discover how embracing autonomous finance can revolutionize your AEC firm's financial operations, enhancing efficiency and decision-making through the power of AI and machine learning.

As the Architecture, Engineering, and Construction (AEC) industry evolves and benefits from the advanced capabilities of artificial intelligence (AI), firms must adapt to changing accounting technology to remain competitive. Autonomous finance, driven by AI and machine learning, offers a transformative approach to managing financial processes, improving efficiency levels, and enhancing decision-making. Here’s how AEC firms can start embracing this new reality.

Understanding Autonomous Finance

Autonomous finance leverages AI and machine learning to automate financial processes, minimizing the need for human intervention. This approach is transforming financial management in AEC firms, streamlining operations and enhancing decision-making.

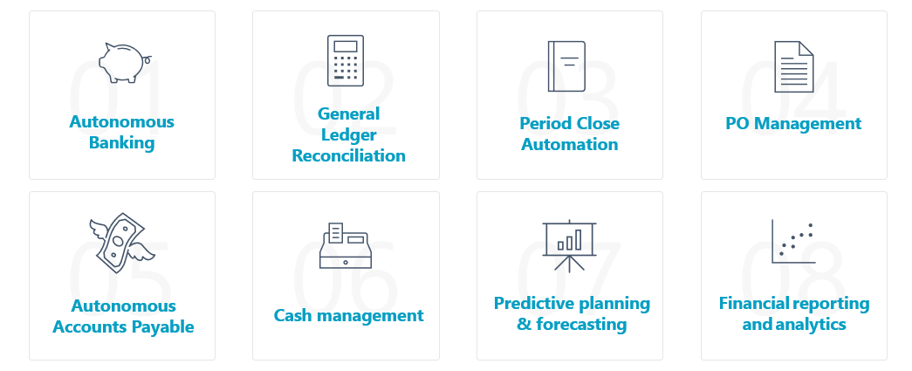

Implementing autonomous finance can yield substantial cost savings and efficiency gains. For instance, automating accounts payable processes can reduce operational costs by up to 90%, significantly impacting profitability. Additionally, predictive analytics can improve cash flow forecasting by analyzing historical customer payment data, allowing firms to better anticipate incoming payments and improve cash collection. Some of the potential use cases include:

Implementing autonomous finance can yield substantial cost savings and efficiency gains: lowering administrative costs by as much as 40% allows firms to free up resources for more strategic initiatives. By reducing the need for manual processing, the firms can decrease administrative staff by 20-30%, allowing for more billable employees for each non-billable one.

Want to dive deeper into autonomous finance use cases? Read our blog The Future of AEC Accounting: Adoption of Autonomous Finance & AI.

- 1

Assess Current Accounting Processes

Begin by evaluating your existing accounting processes to identify inefficiencies. Common challenges in AEC accounting include manual transaction processing and reconciliations, disjointed systems, and lack of visibility of your data. A thorough assessment can help pinpoint areas where automation can have the most impact.

- 2

Define Goals and Objectives

Clearly outline your goals for transforming your accounting department. Whether it’s accelerating the financial close process, reducing processing time for invoices, improving cash flow forecasting, or enhancing financial reporting , having defined objectives will guide your strategy and keep your efforts focused.

- 3

Invest in the Right Technology

Choose an integrated financial platform that supports AI and autonomous finance capabilities. Solutions like Microsoft Dynamics 365 and aec360 offer built-in AI features that automate financial processes, from accounts payable to month-end closes. Look for accounting platforms that can facilitate seamless data integration and real-time analytics.

- 4

Start Small with Pilot Programs

Implementing autonomous finance can feel overwhelming, so start with pilot programs that focus on specific processes, such as automating invoice processing. By testing the technology in a controlled environment, you can evaluate its effectiveness and make adjustments before a full-scale rollout.

- 5

Train Your Team

Ensure your finance team is equipped to adapt to new technologies along with new roles and responsibilities. Provide training on the tools and processes associated with autonomous finance. Cultivating a culture of digital literacy will empower employees to leverage technology effectively and enhance their roles within the organization.

- 6

Monitor and Measure Performance

Establish key performance indicators (KPIs) to measure the impact of autonomous finance on your operations. Track metrics such as processing times, accuracy rates, and cost savings. Regularly review these metrics to assess the success of your implementation and make data-driven decisions for future enhancements.

- 7

Focus on Change Management

As you implement autonomous finance, prioritize change management to ensure a smooth transition. Communicate the benefits of automation to all stakeholders, addressing any concerns about job displacement or shifts in roles. Emphasize that autonomous finance is designed to augment human capabilities, not replace them.

- 8

Scale Up Gradually

Once initial processes are automated and your team is comfortable with the technology, look for opportunities to scale up your efforts. Explore additional use cases, such as cash flow forecasting, risk mitigation, and real-time financial reporting. The broader your implementation, the more value you can extract from autonomous finance.

Real-World Examples

Several AEC firms have successfully embraced autonomous finance, yielding impressive results. For instance, one firm reported a 90% reduction in accounts payable processing costs after implementing AI-driven invoice processing. Another organization leveraged predictive analytics for cash flow forecasting, resulting in improved cash management and reduced late payments.

These examples illustrate the potential benefits of autonomous finance in the AEC industry. By following a structured approach, firms can harness technology to enhance their financial operations.

Discover more detailed examples in our blog The Future of AEC Accounting: Adoption of Autonomous Finance & AI.

On Demand Webinar

Change is Coming to AEC Accounting: Is Your Firm Ready?

This webinar highlights key trends in finance and accounting technology and help future-proof your firm’s financial practices by embracing automation and AI tools to optimize key process around accounts payable, banking, financial close and reporting procedures, and much more.

In Conclusion

The future of AEC accounting will be rooted in AI and autonomous finance capabilities. By embracing this shift, firms can streamline financial processes, improve accuracy, and enable data-driven decision-making, all while empowering their finance professionals to focus on more strategic initiatives. Through careful planning, technology investment, and a focus on change management, organizations can position themselves for success in a competitive landscape.

For more information on how to implement autonomous finance in your AEC firm, consider reaching out to a specialized partner like HSO, who can guide you through the transition and help you unlock the full potential of your finance technology.

Explore other industry resources

Reach Out to Us

Contact us to start a conversation about Microsoft Cloud-based ERP system can help your AEC firm gain efficiencies